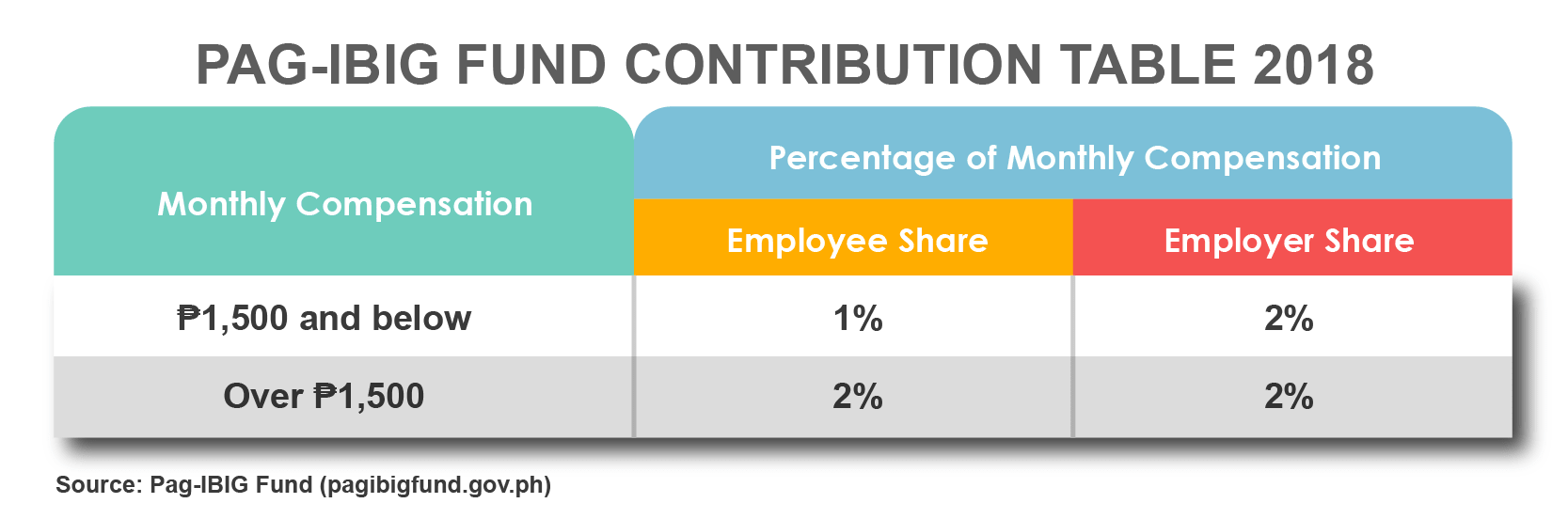

Philippines Mandatory Employee Benefits & Contributions

EPF needs RM46 bil to pay 5% dividend for 2020 The Edge Markets

Basics of Employee Provident Fund - waytosimple

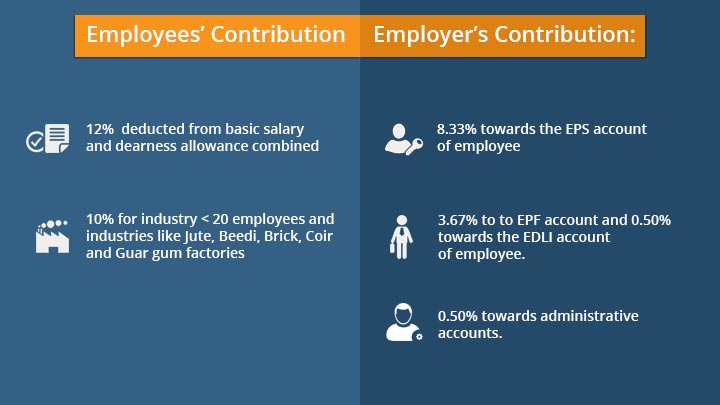

Employees Provident Fund: Scheme and Rates

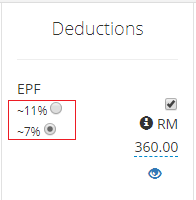

New statutory contribution rate of 2020 - 7% or 11%

Govt says taxation of EPF contribution will not affect genuine

epf contribution rate cut: Govt notifies cut in EPF contribution

Pros and cons to lowering EPF contribution rates The Star

EPF Contribution Rate For Employee and Employer in 2019 - PlanMoneyTax

6 Easy Steps To Check Your EPF Balance Online Using UAN Number

EPF cut in employee contribution means take-home is high but will

EPF Contribution Rates 1952-2009 Download Table

Tags:

archive