Das Tax Consultant Employee's Provident Fund

Employee EPF Contribution Rate Cut: Private Sector Employers

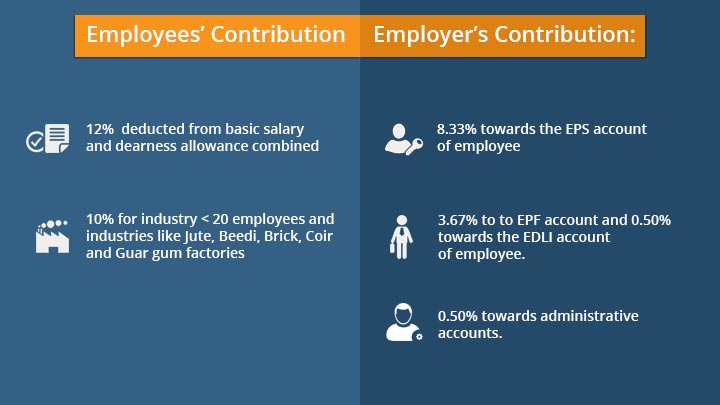

Employees Provident Fund: Scheme and Rates

Latest PF interest rate and the procedure to calculate PF interest

How does a lower EPF contribution impact your retirement savings

6 Easy Steps To Check Your EPF Balance Online Using UAN Number

Govt says taxation of EPF contribution will not affect genuine

Latest Contribution Rate - Employees' Provident Fund w.e.f 1st

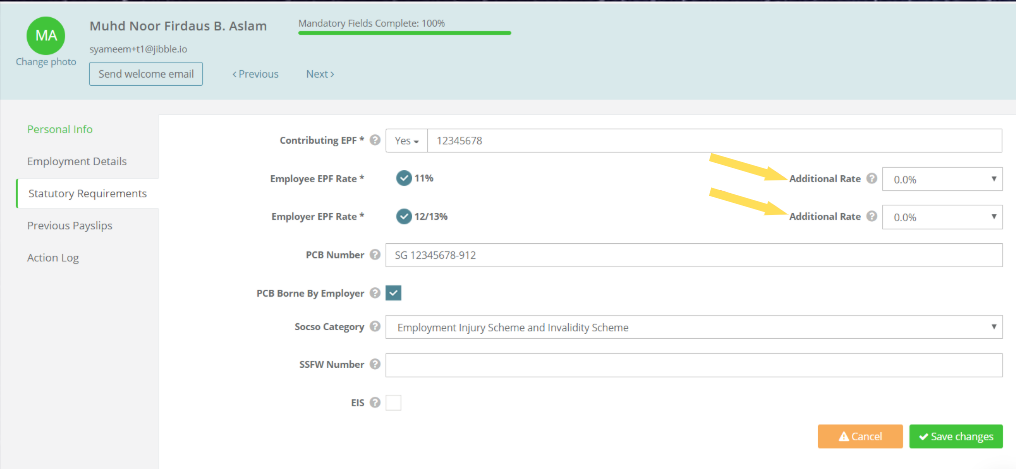

Payroll Panda Sdn Bhd - How to increase EPF Contributions for an

8.15% interest rate on PF to be paid now, rest linked to equity

Budget 2018 highlights: Tax slabs unchanged, standard deduction

EPF cut in employee contribution means take-home is high but will

Tags:

archive